Malta Tax Tables 2025 - Review the latest income tax rates, thresholds and personal allowances in malta which are used to calculate salary after tax when factoring in social security contributions, pension. Tax System in Malta (2020) Tax Rates and Brackets SOHO, Calculate your income tax in malta and salary deduction in malta to calculate and compare salary after tax for income in malta in the 2025 tax year. Tax rates for basis year 2022.

Review the latest income tax rates, thresholds and personal allowances in malta which are used to calculate salary after tax when factoring in social security contributions, pension.

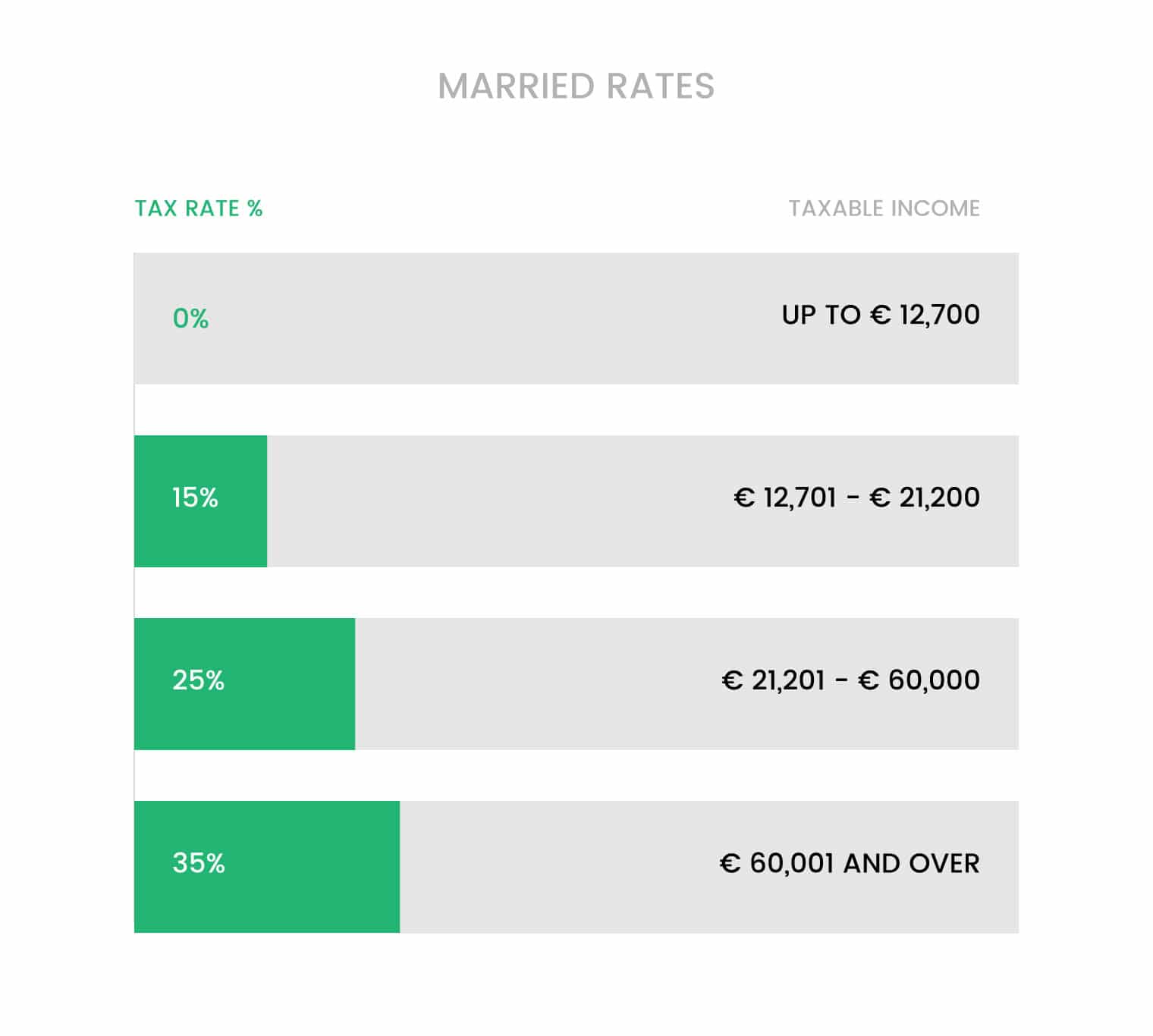

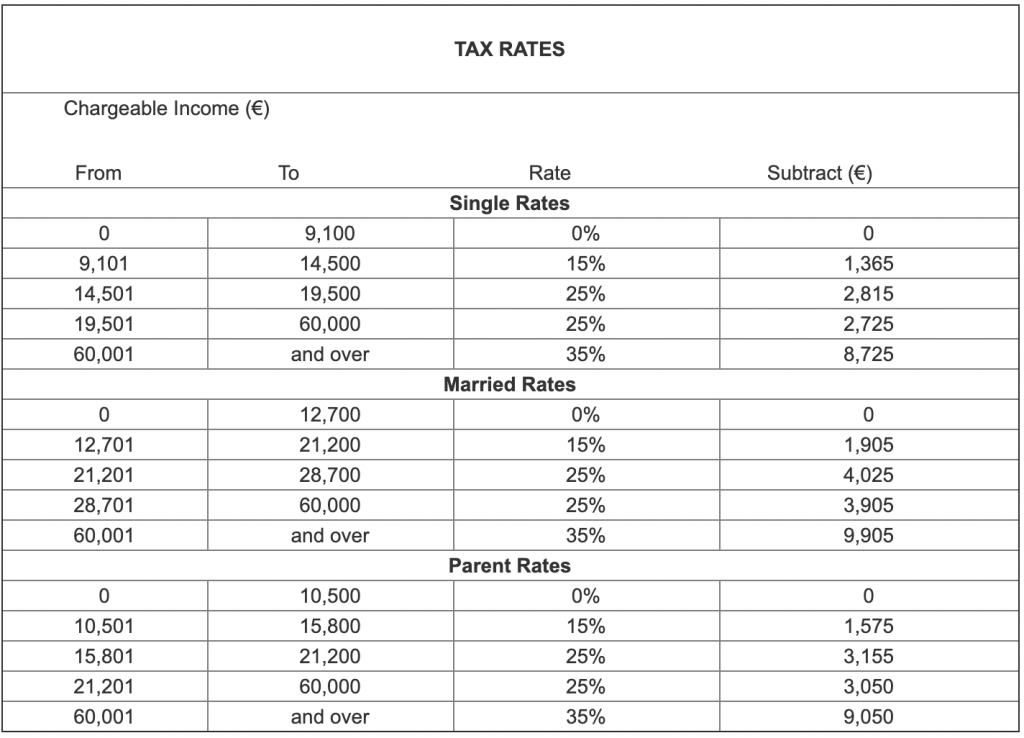

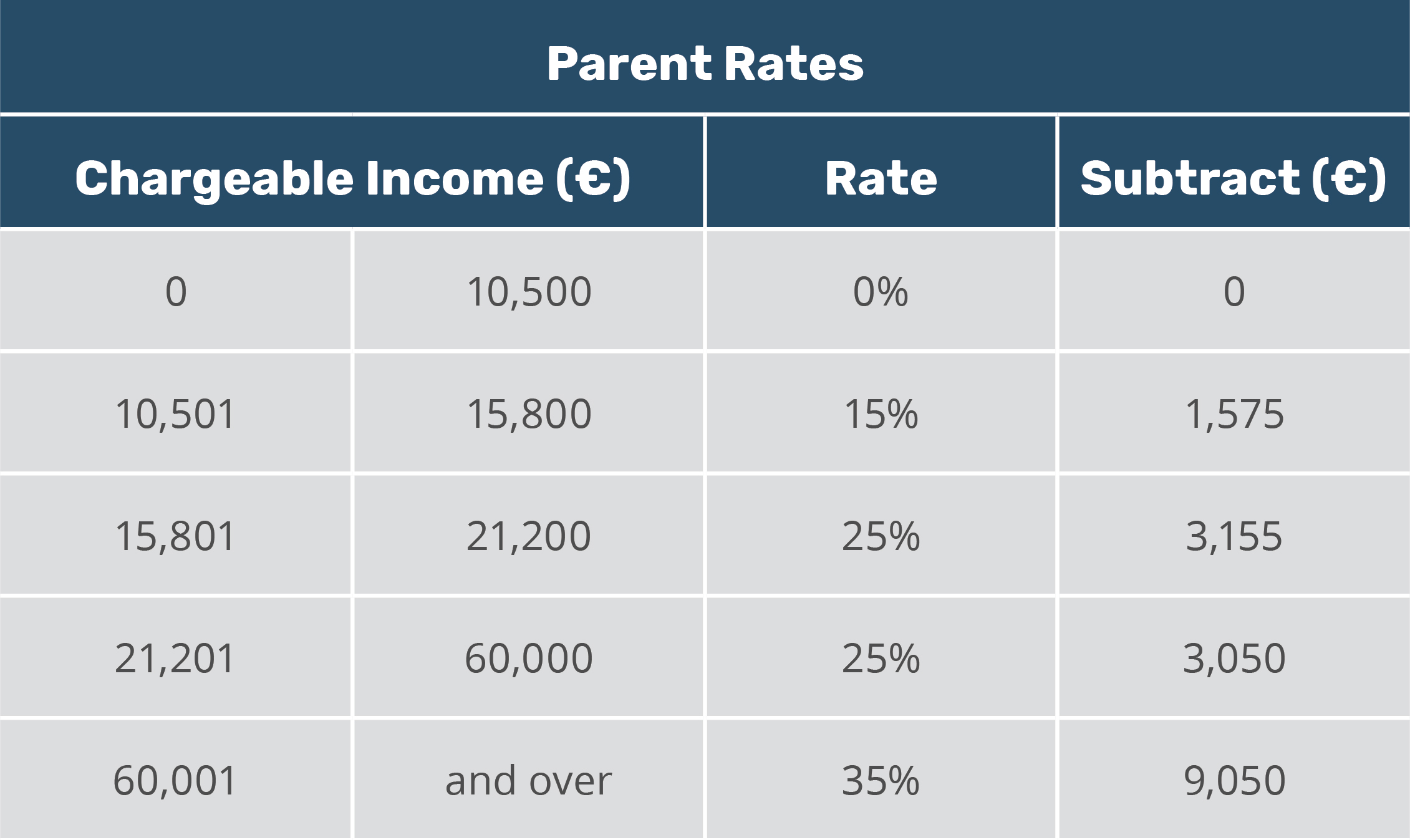

Tax rates for the 2025 year of assessment Just One Lap, Malta's income tax ranges from 0% to 35%. On this page we provide a comprehensive overview of how to use the calculator to estimate your income tax due based on your taxable income in malta in line with the 2025 tax tables.

Malta's international tax evasion problem dwarfs EU average, Calculate your income tax, social security and pension. Chargeable income (€) from to rate subtract (€) single rates.

Tax In Malta M. Meilak & Associates Setting up in Malta, See updated tables for 2025 malta operates a progressive tax rate system, the more you earn the more you pay. Calculate your income tax in malta and salary deduction in malta to calculate and compare salary after tax for income in malta in the 2025 tax year.

The Essential Guide to Payroll Management in Malta Payroll Malta, Take a dive into malta tax benefits, new maltese tax system, indirect taxes and direct taxes. Calculate your income tax in malta and salary deduction in malta to calculate and compare salary after tax for income in malta in the 2025 tax year.

Malta Monthly Tax Calculator 2025 Monthly Salary After Tax Calculator, Calculate your income tax in malta and salary deduction in malta to calculate and compare salary after tax for income in malta in the 2025 tax year. To help you stay on track, here are 5 vital tax dates for malta in 2025 that you should mark on your calendar and prepare for in advance.

Malta Tax Tables 2025 Maure Shirlee, Malta personal income tax tables in 2025. See updated tables for 2025 malta operates a progressive tax rate system, the more you earn the more you pay.

Calculate your tax, ni and net take home pay with malta salary calculator.

Malta Tax Tables 2025. To help you stay on track, here are 5 vital tax dates for malta in 2025 that you should mark on your calendar and prepare for in advance. Malta personal income tax tables in 2025.

Malta Tax Tables Tax Rates and Thresholds in Malta, The malta tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in malta. Tax rates and taxation system in malta.

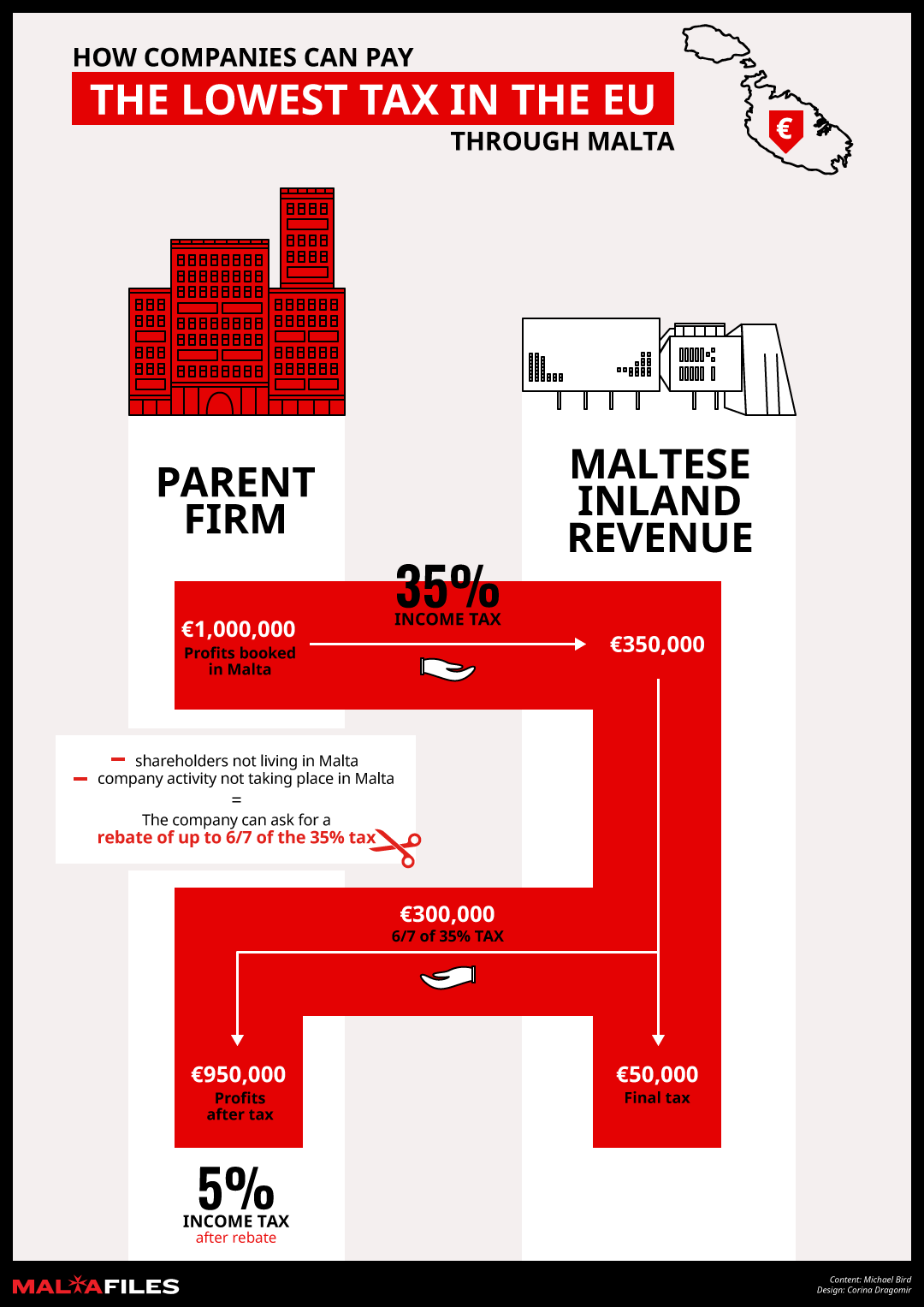

infographicmaltatax Daphne Caruana Galizia, The commissioner for tax and customs notifies that the online service for the filing of the personal income tax for year of assessment 2025, basis 2025, is now enabled. Calculate you annual salary after tax using the online malta tax calculator, updated with the 2025 income tax rates in malta.

Malta Tax Update VAT incentives for Shortterm Yacht Chartering, Tax rates and taxation system in malta. The government expects that inflation will decrease to 3.7% in 2025 and that increases in prices.

Tax return help booklet (english) for basis 2025 tax return help booklet (maltese) for basis 2022 Calculate you annual salary after tax using the online malta tax calculator, updated with the 2025 income tax rates in malta.